Risk Management

Risk management is recognised by the Board as an integral part of responsible management and is an essential element of good corporate governance. The objective of the Group’s risk management programme is not to eliminate risk but to maximise opportunities and create benefits whilst managing potential exposures. This process will help protect the Group against uncertainties that could threaten the achievement of business objectives and will enable sustainable creation of shareholder value.

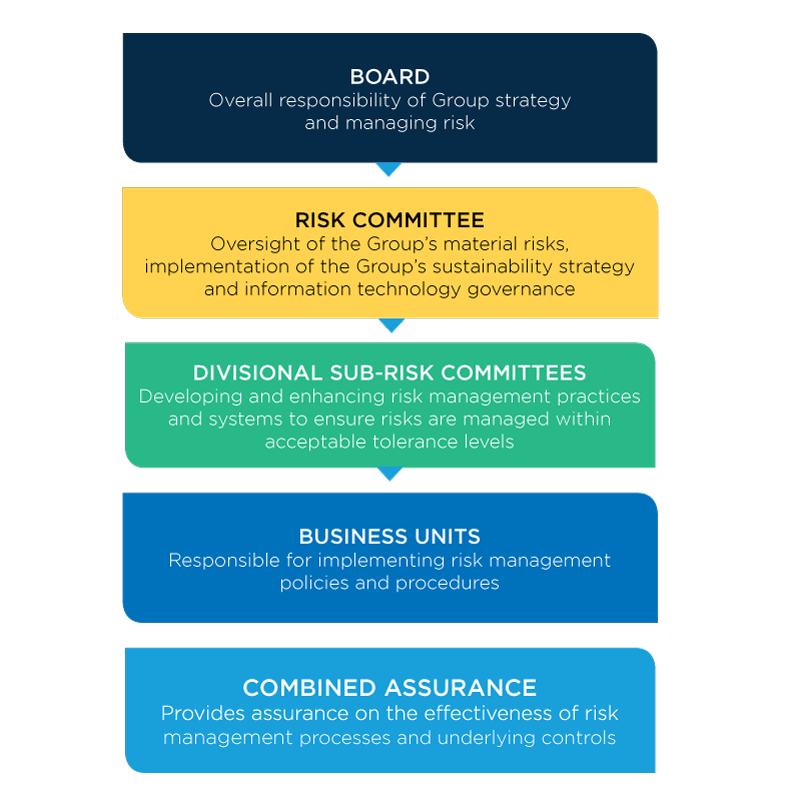

RCL FOODS has adopted an enterprise-wide approach to risk management, enabling a formal and systematic process for identifying and assessing the Group’s material risks. The Board has assigned oversight of the Group’s risk management function to the Risk Committee. The Chairman of the Audit Committee is also a member of the Risk Committee, and the Chairman of the Risk Committee is a permanent invitee at all Audit Committee meetings, thereby ensuring that information relevant to these committees is transferred regularly.

The Board has an approved risk management policy and a formal Risk Charter that defines the objectives of risk management and governs the Group’s response. The charter is based on principles of the International Committee of Sponsoring Organisations of the Treadway Commission (COSO) framework and complies with the requirements of King IV. It involves continuous risk identification at both strategic and operational levels, as well as the evaluation of mitigating controls.

On an ongoing basis, the top risks for each division are updated through a robust revision process and are evaluated for completeness and accuracy at each divisional sub-risk committee. Formal risk assessments are performed bi-annually, where existing risks are reassessed, and new and emerging risks are identified through a combination of facilitated workshops and interviews with Group executives and management.

The Group’s risk management process provides a platform for identifying and realising opportunities to deliver sustainable value for all our stakeholders. Through various strategy and business review sessions, the leadership team is responsible for evaluating key opportunities in line with each Divisions’ strategic objectives, risks and performance. The scope of the Group’s opportunities identified and managed include cost containment initiatives, growth and expansion opportunities and sustainability efficiencies et cetera.

Refer to the Sustainable Business Report and Abridged Integrated Annual Report for more detail on the Group’s opportunities and initiatives, available on our website at www.rclfoods.com/financial-results-and-investor-presentations-2019

Through the Risk Committee, the Board monitors and reviews the risk management process. It considers:

•The material risks facing RCL FOODS and each division, which include the strategic, operational,

compliance and finance-related risks;

• Key mitigations and the adequacy and effectiveness thereof;

• A view on further remedial actions taken in response to the risks identified;

• Scrutiny of the material incidents, root causes and associated losses; and

• Assessment of the results and performance of various assurance providers.

In keeping with the dynamic nature of risks, where the complexity of risks has increased, and new risks have emerged, the Enterprise Risk Management (ERM) function seeks to continually enhance the efficiency of the risk management process. To this end, some of the planned future focus areas include:

Enhancing risk reporting using dashboard tools; and

Continuous improvement plans to maintain and enhance risk culture and communication throughout the Group.

The material risks impacting the Group are listed below and further detail is included as part of the Abridged Integrated Annual Report available on our website at www.rclfoods.com/financial-results-and-investor-presentations-2019

Material Risks

Pricing Pressure

Commodity Price Fluctuations

Supply Chain Business Interruption

Regulatory Intervention and Policy Uncertainty

Food and Product Safety

Customer Relations and Preferences

Climate Change

Non-compliance with Laws and Regulations

Information Security Risk

Fraud and Corruption

Reference to AR

Combined Assurance

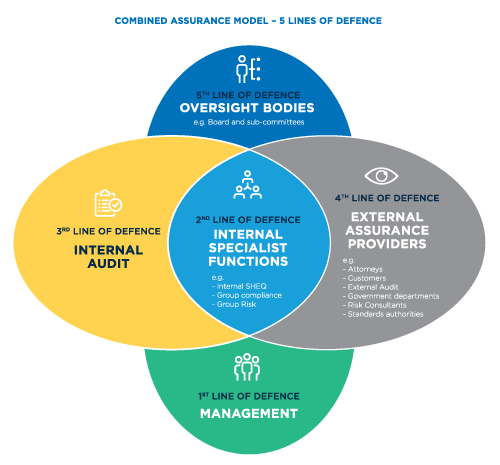

RCL FOODS operates a combined assurance framework which co-ordinates the efforts of management, internal assurance providers and external assurance providers in a

manner that ensures collaboration, and assists in bringing about a holistic view of an organisation’s risk profile and assurance activities. The Risk Committee considers the risks and the assurance provided through the combined assurance framework, and it periodically advises the Board on the state of risks and controls in RCL FOODS’ operating environment. This information is used as the basis for the Board’s review, sign-off and reporting to stakeholders (via the Integrated Annual Report) on risk management and the effectiveness of internal controls within the Group. The five groups of assurance providers to the Group are illustrated below: